Hey everyone, one of the best things in the world of shopping is getting your favorite things at an affordable price, right? And to be honest it is one of the best feelings for everyone.

Let’s take you for example what makes you read this article? Simply, because you look for ways to save some extra cash when shopping, right? Well, you’re in luck.

I have listed here for you some perfect money-saving tips that helped me and still save money every time I shop whether online or in-store, and it will help you as well. So let’s see how you can make your wallet happy.

I will split it into two parts. One is about how to save money online and part two is how to save it in-store.

How to save money online?

1. Promo Codes Are Your Best Friend

Okay, let’s start with how promo codes can completely change your shopping experience. Seriously, they are an absolute game-changer when it comes to saving money.

Why promo codes? Maybe you’re thinking, ‘What’s new? I already know about promo codes.’ But here’s the thing—many people skip them because they assume it takes too much effort to find a valid one.

However, studies show that skipping them could cost you up to $1,465 per year. When you find a valid promo code, it’s truly one of the easiest ways to save extra money.

Let me explain better how these codes will save more. Now let’s take Amazon for example. When you shop there besides the discounts provided by the marketplace every day. The store also has a section where it lists its “Coupons”, you can find it under the Today’s Deals section. So, how do these coupons work?

Well, it’s pretty easy. Simply add the item you want to your shopping cart. On the checkout page, the coupon will apply automatically to your total. This is a great way to save on a wide selection of products listed by them in this coupons section, from electronics and books to clothing and home goods.

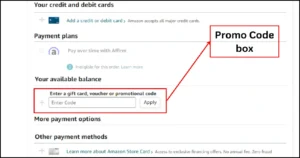

Ok, what promo codes can do so? Well, these are manually entered codes, and most stores allow you to apply them on the checkout page.

Just look around on the checkout you will see a box often labeled ‘promo code’, “enter a coupon code” or “got a promo code”. In this field, you can apply your promo code if you have one, and you will receive an extra discount.

With a combination of a coupon and a promo code, you will save a ton of money. Some stores also allow you to stack promo codes which is another way you can do whenever it is available to save even more.

Amazon promotional code box

So, where to find these codes? Well, Take your time to look for them online. Just type “The Store + promo codes”, for example, Amazon promo codes and you will find many coupon websites that provide them.

However, keep in mind that the big coupon websites are not always the best when it comes to the validity of these promos. Let me explain why.

Well, often these sites list thousands if we don’t say millions of coupons so do you think they can control the validity of all promo codes on their platforms? Of course not.

Read Also: Ultimate Amazon Savings Guide 2025: Tips & Coupons

Otherwise, for small sites that still growing, I believe that they have more control over their promo codes. Also, some of them focus on quality often over quantity. Because it is easy to list thousands of stores in a platform but the question is, do the codes keep updating?

Believe me, sometimes small sites are better at this. So, make sure to check them before you hit that “Buy Now” Button. It’s like giving yourself a little high-five when you see the final total drop. Plus, who doesn’t love that little rush of excitement when you score an unexpected discount?

To show just how potent these codes can be, consider this: in 2022 alone, a whopping 91% of Americans used at least one coupon, while 177.9 million adults redeemed digital coupons.

Furthermore, 86% of online shoppers are more apt to try a new business because of a coupon, while 39% say they would make unplanned purchases simply because they had a coupon in hand.

Otherwise, with the promo codes, you could be practically leaving a lot of savings on the table.

2. Sign Up for Newsletters & Follow on Social Media

Although this isn’t a direct way to save money, it can help you save indirectly. Now, I know what you’re thinking: “I don’t need more emails cluttering my inbox.” But trust me, I get it. Some newsletters are worth signing up for, especially regarding exclusive deals and first dibs on flash sales.

Some retailers and service providers often send special discounts just for those who join their mailing lists. So, this will give you access to hidden gems not publicly visible to no joined shoppers.

And here’s a cool trick: if you are still unsure of something in the store, sign up and wait a day or two before you make the purchase.

In most cases, they will send you an email with a discount code to encourage you to buy! It’s their way of saying, “Hey, we miss you—here’s a little something to come back!”

Also, if you don’t follow your favorite stores on social media yet you should do it now. Most of the time, retailers announce their flash sales, discount codes, and giveaways on their social media channels.

It’s a simple but perfect way to stay updated on quick deals that may not be advertised anywhere else.

To understand how effective these methods are, here are some recent statistics. Over 80% of Americans have subscribed to receive email offers just to get digital coupons and discounts.

In fact, 47% of consumers find coupons through brand emails, while 46% discover them through online searches. These statistics reveal that newsletters and social media are brilliant grounds for accessing premium deals to help you save money.

3. Keep an Eye Out for Free Shipping Deals

Who loves paying for shipping – nobody, In fact, 62% of online shoppers say they won’t purchase from a retailer that doesn’t offer free shipping, and only 3% say shipping costs don’t matter at all to them.

But good news! Most retailers provide free shipping for purchases that meet a particular threshold level. Sometimes, the stores also offer coupon codes to use and get free shipping.

Also, there are some programs provided by some stores that offer free and fast shipping. For example, the Prime program offers exclusive benefits like free two-day shipping on millions of items.

So, If you’re a frequent shopper, subscribing to a program like this can save you a lot of money in the long run. Nearly 50% of online shoppers will spend a minimum amount to qualify for free shipping, so take advantage of it.

And don’t forget that many retailers sometimes offer promotions that provide free shipping during certain periods or for specific products.

Always be on the lookout for free shipping from your favorite stores. Sometimes, even if you don’t reach the order minimum, promo codes for free shipping are available it is always worth a quick check before completing an order.

4. Use Price Tracking Tools & Compare Prices for Big Savings

Here’s a sneaky but effective tip: Think to use price-tracking tools to get the best deal. Haven’t you ever noticed how sometimes, right before products go on sale, their prices go up? Yep, it happens all the time! That’s where the price trackers come in.

These tools will help you track the prices, especially on big sites like Amazon. They will send you notifications when the price has dropped to allow you to purchase that product at the lowest price.

Read Also: Amazon Price Glitches: Myth or Money Saver?

Also, before you click that checkout button, it’s a good idea to take your time to check alternative stores to the one you are using to purchase and compare prices. You can really save money this way.

Sometimes, the same product from different online stores is offered at different prices. A comparison tool like Google Shopping will give you an idea pretty quickly whether your price is any good. Quite often, the price difference may just surprise you.

5. Timing is Everything

Ever heard of FOMO, fear of missing out? Well, it turns out patience truly is a virtue when it comes to saving money online. Stores love having seasonal sales, especially around Black Friday, Cyber Monday, or even those random clearance events.

If you can wait, hold off on that purchase until one of those sales rolls around. And you know what’s even better? You can still add your coupon codes for extra savings.

The best part? Even during such sales, you can combine deals with coupons to save even more. Timing is everything; just be strategic, and you will get some of the best deals out there.

Read Also: Amazon Refund Trick: Why You Should Avoid It in 2025

How to save money In-Store?

6. Create a Budget and Stick to It

The first thing you have to start with is to determine your budget unless you are a billionaire (though many of them still use budgets to manage their finances effectively).

However, as people discuss the setting of the budget, the first that they always consider is the 50/30/20 rule. I practice this method and you know what, it helps a lot.

I was the worst person when it came to handling money. I spent impulsively and never seemed to have enough money to save until I discovered this rule.

So, how does it work? Simply, like this:

- 50% of your income goes to necessities, which are the bills that must be paid and the necessary things you need for survival (like rent, groceries, and utilities).

- 30% goes to wants—the things you spend money on but are not essential (like dining out, entertainment, and hobbies).

- 20% goes to savings.

I really encourage you to give this rule a try. It will help you control your finances.

Here is an example:

- Calculate your total monthly income.

- List your fixed expenses (rent, utilities, groceries).

- Divide funds according to the 50/30/20 rule.

By sticking to your budget, you’ll be surprised at how much more you can save.

7. Automate Your Savings Based on Your Budget

You have now set your budget; make saving as easy as possible by doing it automatically. Let’s explain how.

You should set up an automatic transfer to move some money from your checking account to the savings account; this should match the 20% savings rule from the budget.

This will help you consistently save without having to give much consideration to it. It will also assist you in how you can be able to convert the aspect of saving into a habit.

For example, if you automatically save $100 from each paycheck, at the end of the year you’ll have around $2,600 saved up without any extra effort. It’s the easiest way to make sure you’re saving regularly.

8. Pay Off High-Interest Debt First

After your budget is in place and savings are automated, you need to know and deal with any high-interest debt you have. It will help you to cut expenses on interests from the simplest interest more over from the compounded interests.

Try to divide a part of your 20% savings needed to pay off your debts using either the debt avalanche strategy, where higher interest-bearing debts are paid off first, or the debt snowball method where the smallest balances are paid first.

This strategy will reduce financial stress and free up more of your income for savings and future investments.

9. Cancel Unused Subscriptions to Free Up Extra Cash

Now it’s time to free up even more cash with a simple change. A simple change is checking out those recurring expenses and subscriptions that get paid but are not being used or have not been used in a while. These tiny monthly expenses add up and become barely noticeable over time.

You can free up more money by canceling services you don’t use and putting that money toward paying off your debt faster or increasing your savings even further.

10. Cook at Home to Save on Dining Out Costs

Food-wise, eating out or buying expensive meals once in a while means the budget goes up the drain in no time.

When you cook your food at home more often, not only does it save you money by paying low food bills but also control of the meals and the ingredients used are checked leading to improved nutrition standards.

Plan your meals for the week and make a shopping list that’s aligned with your budget. The less dependent you are on food from outside, the cheaper it is, which will help you stay within your limits while increasing savings.

11. Lower Your Home Energy Costs

If you are already considering cutting dining costs, why not lower the household costs as well? This can be done in many ways for example by reducing your energy usage.

Small changes such as replacing bulbs with energy-saving ones, switching appliances when not in use, and or controlling the temperatures. By paying lower energy bills or Bills, you can save more money or spend it on other requirements.

12. Buy in Bulk (When It Makes Sense)

Purchasing by bulk may be useful sometimes but it should approach it strategically. For instance, it’s better to buy non-perishable items like paper products, canned products, and cleaning accessories among others.

This strategy will reduce the number of your shopping visits, and also the time spent to get from one shop to another. Moreover, you might enjoy better prices in terms of per unit as well as quantity discounts.

13. Shop Off-Season

One of the most efficient strategies when it comes to saving is buying off-season. For instance, you can buy coats, jackets, and boots for winter at a cheaper price during spring.

Similarly, Summer items like beach towels and outdoor grilling equipment will cost less during the autumn. This is because, during the end of any season, most retailers offer massive promotions to clear out inventory.

14. Be Mindful of Sales Tactics

A lot of people overspend due to the smart promotion strategies used by retailers like, “limited-time offers” or “buy one, get one free” deals.

Don’t let flashy promotions convince you to buy things you don’t need, even when certain bargains are tempting. Always asking yourself if you would still purchase the item if it weren’t on sale will help you avoid unnecessary purchases.

15. Negotiate for Larger Purchases

This is where negotiation comes into play. Haggling is fine, especially when the items you’re purchasing are big things like sofas, fridges, or washing machines.

Some stores are willing to match the price levels of competitors or better if requested. Furthermore, it is possible to negotiate for especially better offers like free shipping or extra guarantees.

16. Avoid Overspending on Credit Cards

Credit cards are an easy way to overspend because people are more likely to use them now and think later. To avoid this, ensure that you only pay cash or if necessary use a debit card only.

However, if you need to purchase with a credit card, ensure that you pay for this card in full every month to avoid accruing interest charges.

Conclusion

By applying these easy tips to your lifestyle, you will be able to save on monthly expenses without creating great pressure on yourself. If you want to take these tips regularly then you can save a huge amount of money.

So, take charge of your financial situation, and be free with more secure financial stability. Please remember that this course’s purpose is to help you make the right choices to fund your goals without having to sacrifice one’s quality of life.

Zouhair is a freelance writer, designer, and the founder of Couponfyi.com. He created this platform in 2023 to help online shoppers make the most of their hard-earned cash. Starting from smart shopping tips and honest reviews to the latest coupon codes & offers, Zouhair shares the best value to help others grow their savings. Before creating his business, he spent five years in logo design and marketing, helping businesses build their brands. Zouhair lives in Morocco.